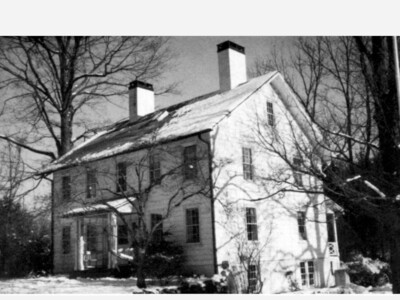

Reynolds Asset Management Nears Completion of Stissing Farm Townhomes, Brings Units to Market

First New Condominiums to Hit the Pine Plains Market in 15 Years

PINE PLAINS, NY (March 25, 2022) – In its continued dedication to addressing housing needs in the Hudson Valley, Reynolds Asset Management

(Reynolds) announced that it is nearing completion of the first 10 of its 38 additional planned residences on its Stissing Farms Townhomes property. With a total of 48 townhomes planned for the community, Reynolds’ move to bring the units to market will mark the first time that new townhomes will be available for purchase in Pine Plains in more than 15 years. The 10 new units, along with the 10 original units, will soon be available for purchase, with the remaining 28 homes slated for completion by Spring 2023.

“We’re proud to bring new life to a formerly stalled development,” said Lou Reynolds, founder and CEO of Reynolds. “We’re excited to see the positive ripple effect it will have, including creating new local jobs and increased vibrancy. These homes will bring new taxpayers to town, increase overall tax revenue, and bring in more patrons to shop at local stores and dine in the area’s restaurants, like Stissing House, which opened earlier this month. Fostering this kind of economic growth is at the core of every project, and we couldn’t be happier to be laying down roots in Pine Plains.”

The townhomes will range in price from the low $300k’s to the mid $400k’s for a standalone unit with a walkout basement. All 1,200-square-foot units will include two bedrooms, two bathrooms, a basement, garage, and high-end finishes.

“Bringing these townhomes to market will finally give this property the purpose that Pine Plains always intended it to have and one that answers a deep demand—a for-sale, market-rate, townhome community,” said Matthew Earl, chief operating officer at Reynolds. “We’ve received plenty of early interest from buyers and, out of respect and courtesy for prior residents in the existing community, have offered tenants the option to purchase their units at a significant discount, with their closing cost covered by our asset management company.”

“There is a need for housing of all kinds in Dutchess County,” said (Lou) Reynolds, who himself has ties to the region as a Marist College graduate and whose company will soon unveil Violet Estates, a new 55-plus luxury apartment community in Poughkeepsie. “Given our dedication to communities beyond our own developments, we’re excited to see how we can continue to foster economic and residential growth here in the Hudson Valley.”

About Reynolds Asset Management

Founded in 2003, Reynolds Asset Management is a vertically integrated commercial real estate investment and development firm, primarily specialized in multi-family apartment living. Based in Paramus, New Jersey, Reynolds’ residential development portfolio includes multi-million-dollar, multifamily projects in New York, New Jersey, Connecticut and Florida. For more information on current projects, visit http://www.reynoldsasset.com/ or connect with the firm on LinkedIn.