Real Estate Experts Explore Trends in Designs, Demands for Manhattan’s ‘Higher’ Living

A roaring stock market and low interest rates fueled Manhattan’s luxury housing market in 2021. A wave of deals is expected in the first quarter of 2022, as international buyers return and demand continues for high-end high-rises. How will this play out for New York City and the region, as mortgage rates creep up and the stock market rollercoasters on? Leading real estate experts weighed in on the market at a Feb. 10 virtual panel hosted by the Hudson Gateway Association of Realtors, Inc. (HGAR) and OneKey® MLS.

“Getting the Deal Done: Pent-Up Demand – The Rise of Penthouses and High-End Properties” featured Meris Blumstein, licensed associate real estate broker, The Corcoran Group, NYC; Dana Schulz, editorial director, Marketproof, a NYC-based real estate intelligence and analytics company, and Steve Cohen, associate broker, Douglas Elliman Real Estate, NYC.

“The market definitely softened in the fourth quarter but, right now, we are on par with the first quarter of 2021 and are carrying that momentum into 2022,” said Richard Haggerty, CEO of HGAR and President and Chief Strategic Growth Officer of OneKey® MLS, the regional multiple listing service for New York.

Haggerty kicked off the discussion with an overview of New York’s market, citing OneKey® MLS data to compare pricing trends for single-family houses over the last two years and noting “incredible price growth across the board” in January 2022 over January 2020.

“In Westchester, we’re seeing a 13% increase in the median sale price; in Sullivan County, it’s 97%, and in Suffolk, where we’ve got The Hamptons, it’s 30%,” Haggerty said. “When you think about what it was like when Covid hit, and how quickly we have recovered, it really is staggering.”

The event was moderated by Brian D. Tormey, NTP, President of TitleVest, a leading NYC-based provider of title insurance and related real estate services. The hour-long discussion included a history of New York City’s luxury properties, the rise of Millionaires’ Row on 5th Avenue with a nod toward “The Gilded Age,” today’s Billionaire’s Row and the penthouse evolution, and trends in design, demand and inventory.

The panel was asked how the rise of cost per square foot over the past decade is impacting the luxury market and whether the growing percentage of units above $2,000 per square foot would continue or plateau.

“If you look at the history of pricing in New York City, it peaks, flattens and then goes back up above where it peaked before,” said Meris Blumstein of Corcoran. “I expect that will be the case going forward. We’re at a pretty comfortable place, other than with some of the new buildings being priced above $5,000 a square foot. Generally, if you’re priced correctly, you’re getting sold. If you’re priced too high, you’re sitting on the market ... unless it’s something very unique.”

Steve Cohen, of Douglas Elliman, agreed. “The right pricing is always important – otherwise a property can simply sit. Particularly in this market. In Manhattan, we’re seeing some bidding wars and we’re potentially getting back to a seller’s market. There is high demand right now and inventory is low, so that’s part of what’s driving it, but properties still have to be priced right.”

The panel wrapped up with a look at luxury markets in other boroughs and surrounding areas of New York City. “They, too, are enjoying a bounce-back,” said Dana Schulz of Marketproof.

“We’re seeing these ultra-luxury units spreading across Manhattan so of course that’s going to spill over to the boroughs,” Schulz said, and pointed to new developments like Skyline Tower in Long Island City, which had the most sponsor contracts of any NYC new development in 2021, and 11 Hoyt in Downtown Brooklyn, which came in second.

“We’re seeing it with the pricing and even the media attention buildings in Brooklyn and Queens are getting,” Schulz added. “Quay Tower in Brooklyn Heights had a $20 million sale, another $10 million sale. And, the new one everyone is talking about – Olympia Dumbo – they have the highest price per square foot, about $2,200, in the borough with a penthouse priced at $19.5 million.”

“Getting the Deal Done” is part of the “Be Your Best” webinar series created by HGAR and OneKey® MLS, to help Realtors and agents navigate a changing landscape amid the pandemic. The event was sponsored by TitleVest. View the webinar here: https://www.youtube.com/watch?v=ySDQ9SfYvWM

About OneKey® MLS

OneKey® MLS has 46,000-plus subscribers and serves Manhattan, Westchester, Putnam, Rockland, Sullivan, Orange, Nassau, Suffolk, Queens, Brooklyn, and the Bronx. It was formed in 2018 by the Hudson Gateway Association of Realtors and the Long Island Board of Realtors.

About Hudson Gateway Association of Realtors®

The Hudson Gateway Association of Realtors (www.hgar.com) is a not-for-profit trade association representing more than 13,000 real estate professionals in Manhattan, the Bronx, Westchester, Putnam, Rockland and Orange counties. It is the second-largest Realtor association in New York, and one of the largest in the U.S.

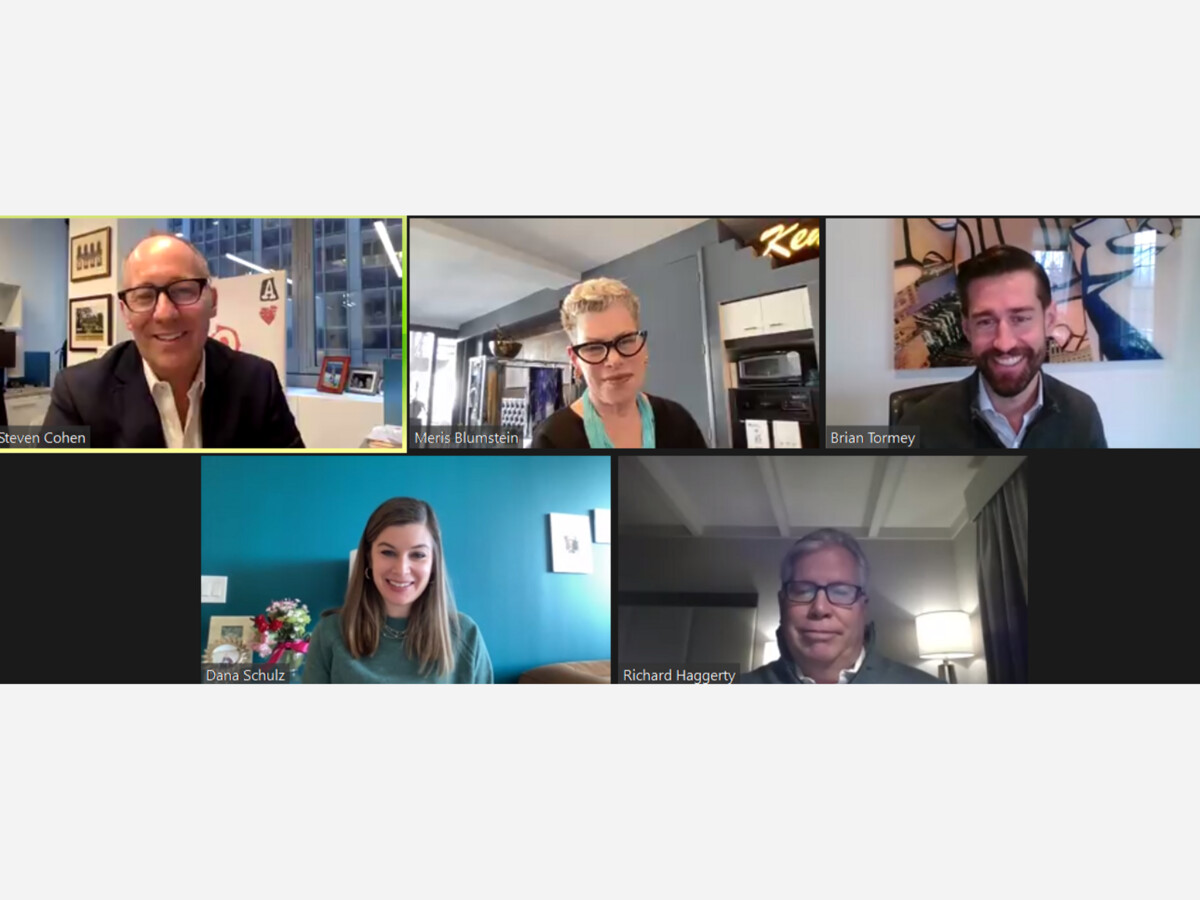

Photo Caption:

Featured in the Feb. 10, 2022 webinar, “Getting the Deal Done: Pent-Up Demand,” were (top row, from left): Steve Cohen, Associate Broker, Douglas Elliman; Meris Blumstein, Associate Broker, Corcoran Group; Brian Tormey, NTP, President, TitleVest; (bottom row) Dana Schulz, Editorial Director, Marketproof; and Richard Haggerty, CEO of HGAR and President and Chief Strategic Growth Officer of OneKey® MLS.