Image

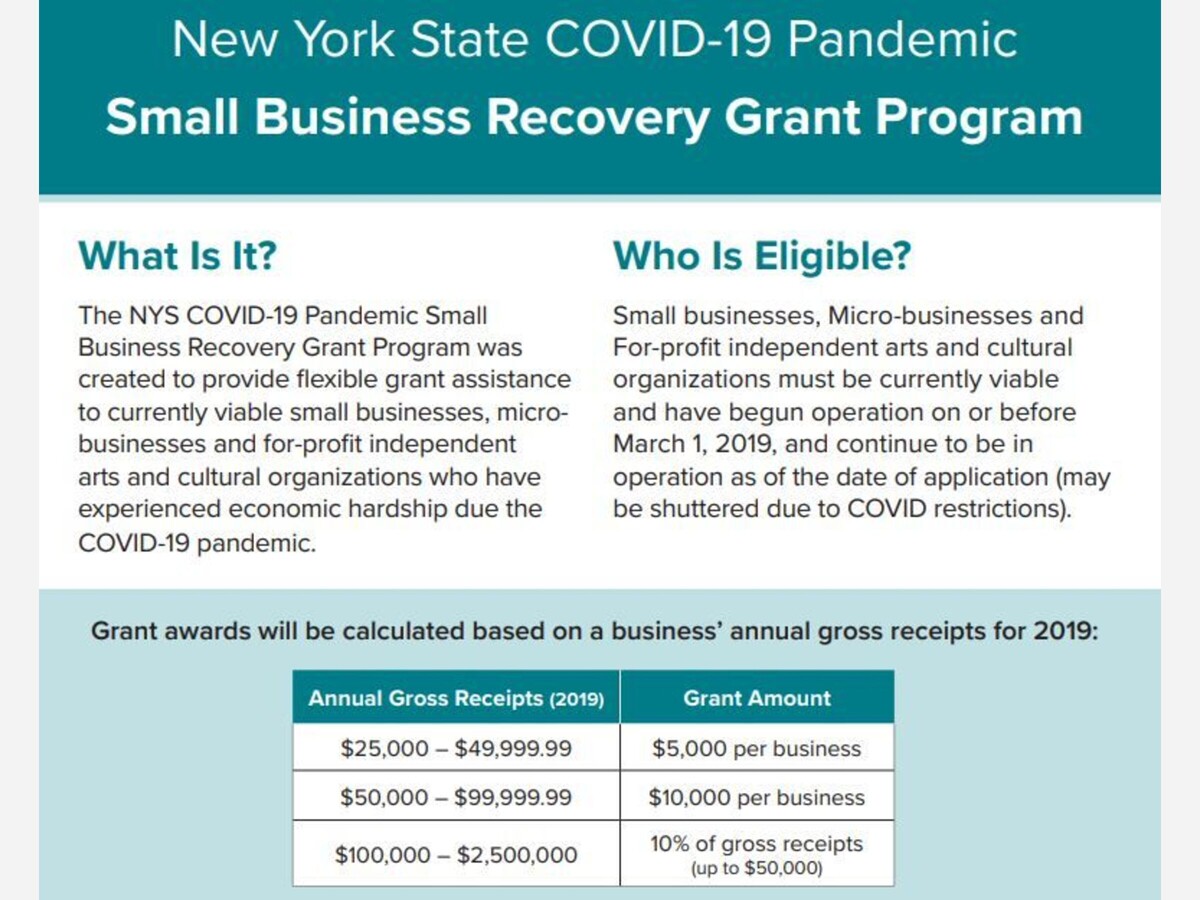

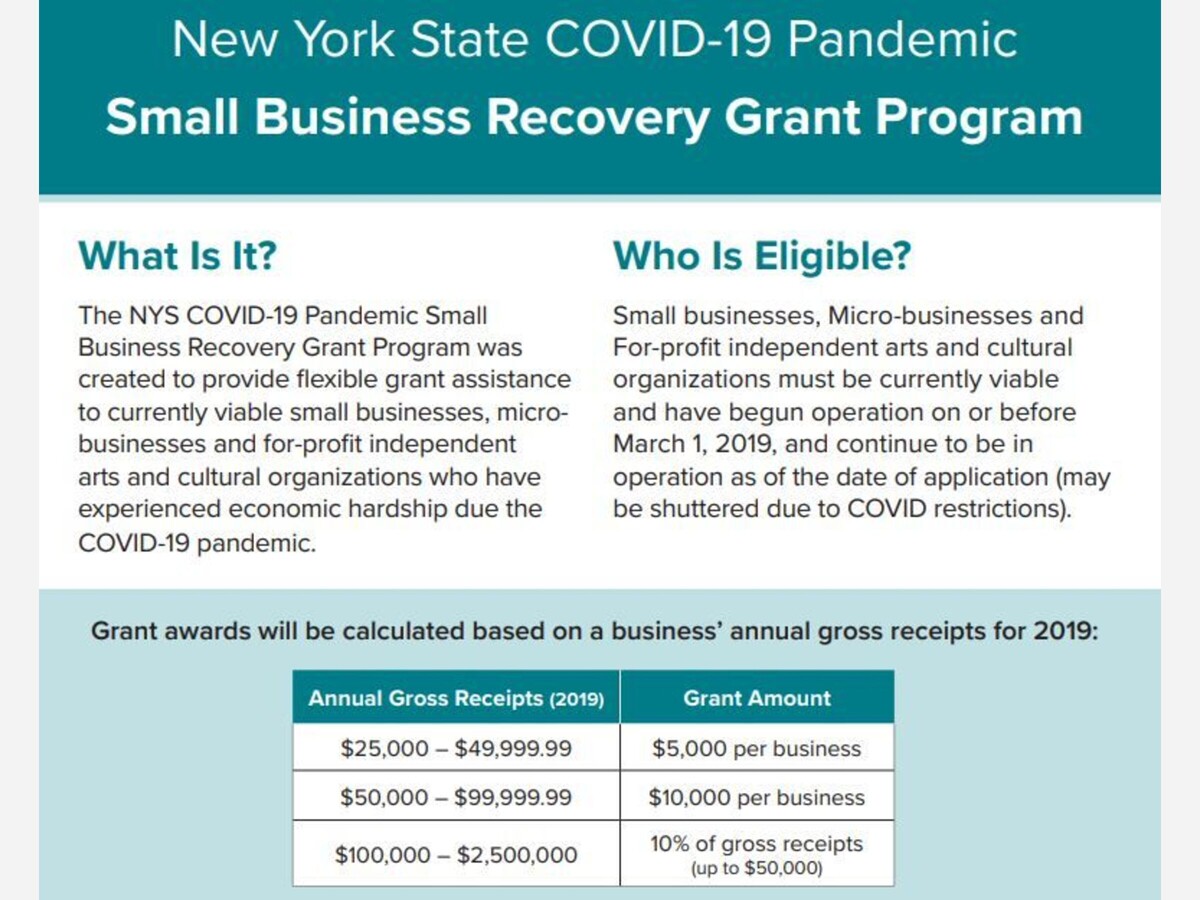

New York State $800 million Small Business Pandemic Recovery Grant Program

Your community business may qualify to apply for a grant of $5,000 - up to $50,000 from New York State! Please encourage application and share this information with your customers and business stakeholders as soon as possible. A Program flyer and QR code is provided for you to distribute in your e-newsletters, at events, gatherings, and at your association meetings. If you would like to host a webinar about this Program, please do not hesitate to let me know. We are here to support the recovery of businesses across NYS.

The New York State COVID-19 Pandemic Small Business Recovery Grant is administered by Empire State Development (ESD) and powered by Lendistry. The $800 million program was created to provide flexible grant assistance to currently viable small businesses, micro-businesses and for-profit independent arts and cultural organizations in the State of New York who have experienced economic hardship due to the COVID-19 pandemic.

On August 25, 2021, Governor Kathy Hochul announced the expanded eligibility to the program to enable more small businesses to apply for funding.

Businesses with revenues up to $2.5 million, up from the previous threshold of $500,000, are eligible for grants and are now encouraged to apply.

The limitation for businesses that received Federal Paycheck Protection Program loans has been increased from $100,000 to $250,000.

Who is Eligible?

Small businesses, micro-businesses and for-profit independent arts and cultural organizations with fewer than 100 employees that are currently viable and have begun operation on or before March 1, 2019, and continue to be in operation as of the date of application (may be shuttered due to Covid-19 restrictions).

Small businesses and micro-businesses must:

Eligible Use of Funds:

Grants must be used for Covid-19 related expenses incurred between March 1, 2020 and April 1, 2021. These include:

Please visit www.nysmallbusinessrecovery.com for more information or to apply. For language assistance, guidance on eligibility requirements or any additional questions, please contact the program's call center at 1-877-721-0097.